Opportunities Abound, Discipline Not Forgotten

Introduction

The year 2017 strangely feels reminiscent of 1993, as we are living in the dawn of the next internet, or Web 3.0: a new paradigm where applications, users, and connected devices interact directly with each other.

“Bitcoin became the first decentralized digital currency in 2009, and is an entirely new asset category: It is “used for payments like a currency, is scarce like a commodity, distributes ‘special dividends’ (hard forks) like a stock, and derives additional value from developer contributions like a technology platform.” As of Nov. 1, 2017, there were approximately 1,248 cryptocurrencies and protocol tokens in circulation. Initial Coin Offerings (ICOs) are the most common blockchain fundraising method for pre-product teams. As of Nov. 5, 2017, ICOs have raised more than $3.8 billion YTD; in Q3 2017 alone, ICOs raised 32 percent as much as Series A startups.

As pre-seed investors, Bee Partners’ mandate is to make informed bets on the business applications of emerging technologies without being blinded by the proverbial hype curve. If a given business or industry involves audit trails or data tracking, and there's a chance that some participants in those processes may want to manipulate the data, then in theory blockchain technology would add value by providing immutable and cryptographically secure audit trails and data records. These opportunities range from blue ocean businesses to an existential threat across legacy businesses, marketplaces, and even venture capital. There will be winners and losers, but those who get in early potentially have the most to gain. Perhaps in several decades, digital currency will even replace traditional fiat altogether.

Below we present our insights and guiding principles on how to skillfully seek out and evaluate blockchain-based opportunities. As always, we welcome your questions, comments, challenges, and Founder introductions.

Key Criteria for Blockchain Investments

Below are key questions we ask when considering blockchain-based businesses and teams.

IS BLOCKCHAIN CRITICAL?

We are focused on use cases that require the blockchain for the idea to work most effectively. The relevant parties must be incentivized to participate in the chain, and do so swiftly. At Bee, we ask, “What about your business will be accelerated, dramatically improved, or enabled by the implementation of a general public ledger.” The value of applying blockchain must supersede the inefficiency and redundancy of the decentralized consensus mechanism, otherwise founders would be far better off applying centralized systems. Here are four foundational elements for deploying the blockchain:

- A database is needed.

- That database needs multiple writers.

- You don’t trust all the writers.

- You don’t want a trusted intermediary.

DOES THE BUSINESS HAVE RUNNING CODE OR A PLAUSIBLE WHITE PAPER, AND A TEAM THAT IS CAPABLE OF WRITING, LAUNCHING, AND SUPPORTING THE CODE.

Substantial technology diligence is the critical path in evaluating a blockchain opportunity; we are prepared to evaluate the core protocol, the lead developers and surrounding community, and the white paper including business opportunity. Many ICOs are considered weakly grounded, as the white paper is merely marketing material and the team is unproven, often especially in terms of business model proposition and technical capability. In the worst case, some are fraudulent. Sound diligence begins by validating those behind the facade.

DOES THE STAGE AND CAPABILITY OF THE BLOCKCHAIN MATCH THE AMBITIONS OF THE BUSINESS?

Current scalability issues include costs, time, and energy consumption. For example, Ethereum is not nearly capable of supporting the transaction volumes of Facebook and Twitter applications today. The blockchain requires time for consensus to happen, and will never be as fast as centralized systems, all else being equal. However, there are businesses that are delay-tolerant, or intended to operate at a lower velocity, that are well suited to leverage the chain. And, we are keeping a close eye on the rapid stream of innovations like SPECTRE (each “DAG” block may reference several predecessors), Chia Network (proofs of time and storage), Casper (Ethereum’s version of “proof-of-stake”), and zk-SNARKS (zero-knowledge proofs to optimize privacy at increased speed with decreased storage), all of which are boldly redefining fundamentals to improve scalability.

DOES THE BUSINESS TAKE GOVNERNANCE SERIOUSLY?

Put simply, this isn’t simple. While initial technical design is important to incentivize participants to join the network, over the span of time the governance mechanisms for change are most critical, as they accrue to these participants rather than to the traditional management teams. Governance dictates incentives and mechanisms for coordination, and is akin to creating a new Central Bank; many attempts will fail gloriously. For example, Bitcoin has a checks-and-balances system wherein developers can submit pull requests just like a legislature proposes new bills; miners, like the judiciary, decide whether to leverage the new version in practice; and nodes, like the executive branch, can veto by not running the new version. Economic incentives (block rewards for miners, increased token value) must make it a no-brainer to maintain trust in the system. The organizers of SegWit2x struggled for three years but could not achieve consensus to increase the Bitcoin block size for scaling purposes.

IS THE BUSINESS PROPERLY CAPITALIZED?

Some founders fundraise to build the actual business, and then do an ICO (Storj - $30M, Brave - $35M, and Civic - $33M) to get participant buy-in onto the network. This is a growing trend that inspires confidence in a solid business foundation (and room to pivot as needed, which is much harder post-ICO) beneath the token-fueled valuation. Much is still uncertain here, and we will discuss this more in our follow-up “Note on Ownership.”

DOES THE BUSINESS MODEL EXTRACT ECONOMIC RENT?

Any viable investment opportunity must have a path to a sustainable business model. Whether it be through token retention on the DApp level or through centralized add-ons resulting in revenue that exists alongside a DApp offering, the company must be building a product or service customers will pay for and that it can defend in the long run.

IS THE BUSINESS “FULL STACK”?

There is consensus in venture that you need to be a “full stack” company. Beyond building the AI, you need to be building the full company that leverages that technology to get lock-in. As we continue to be uncertain of where blockchain value accretes to, we will seek out opportunities that are full stack to increase our likelihood of capturing value.

DOES THE BUSINESS RELY ON THE EXCHANGE OF NON-PHYSICAL ASSETS, OR ASSETS THAT DON’T REQUIRE OPERATIONAL COMPLEXITY?

Inherent in its premise, disintermediation cannot offer value through coordination and management of human capital. The prevalent, centralized captures of value today will not translate to the decentralized captures of value in the future. For example, Amazon demonstrates unyielding determination, reinvests profits, and boasts an impressive management team and corporate culture that provides users with unmatched prices, optionality, and convenience. What good would come from decentralizing Amazon?

IS THE BUSINESS BUILT TO CAPTURE POTENTIAL NETWORK EFFECTS?

A blockchain business offers users partial ownership of the network through a token, theoretically solving the classic [cold start] chicken and egg problem in attracting users to a platform. Yet in practice to date, the ownership upside potential of the major centralized, networked businesses (e.g., FANGs) has not actually decreased as the networks grow, but rather remains extremely high as their networks have grown. These businesses continue to centralize offerings and bring new forms of value to the users of the network, driving monetary reward for themselves in addition to their users. However in a DApp, users have the most financial upside by joining a network and buying tokens early before the network reaches its full capacity and token price increases. They then benefit from the network utility when the network expands, similar to the networked businesses of today. As such, users are incentivized to expand the network to both fuel the token’s rise in value and to improve the utility of the network.

There are various types of network effects (blockchain, platform, currency, general) emerging and to date we actually lack the killer DApp that demonstrates utility network effects. The security network effect of joining a blockchain with a large consensus group makes attack more difficult. The platform network effects include payment systems being more attractive to merchants and users the more of them there are, developers being incentivized to create tools on popular platforms, and third-party integrations becoming more likely with more users. The currency network effects include fungibility, stability (that tends to come with a large market cap), ability to use said currency as a unit of account, and having a higher market depth to convert larger sums of money cost-effectively and efficiently. Traditional N+1 network effects include token marketing benefits and regulatory legitimacy. Finally, token prices can be deceiving because they are composed of both a utility and a speculative value (just like high-growth stocks), creating additional uncertainty. So as with any early-stage venture, we will be critically evaluating the combination of team vision, business model, go-to-market strategies, and actual token usage to determine how this theory unfolds into a reality.

IS THE BUSINESS MINDFUL OF THE PROTOCOL LAYER?

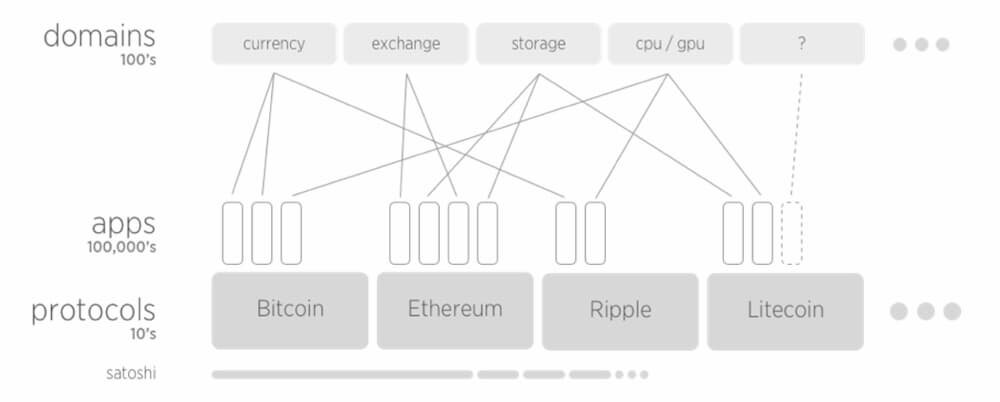

Some argue that the success of any decentralized application generates speculation at the protocol layer, and therefore the protocol market cap (vis-a-vis the token) typically increases faster. They posit that, similar to an index fund, holding a protocol token provides market exposure as broad as that protocol's application. The open network and shared protocol data layer provides a service (e.g., computing in the case of Ethereum), and the protocol token enables access. The protocol serves as a platform upon which many apps and tokens can be launched. Domains can extend beyond the original token reference design, and subsequent applications, in different "domains," begin to appear (or what we call “domain hopping”) on the protocol.

This interoperability of protocols, apps and domains looks something like this:

However, we are beginning to see actual market forces causing a washing-out or throwing off the monetary effect of the rise in value of ether (Ethereum’s token). This value accretes (often inadvertently) into the Altcoins built atop the protocol, or conversely where the Altcoins lag in value to ether’s rise. Ether’s price might fall on day when tokens are launched. Further, “fat protocols” is a simplification, as any layer of functionality can be considered a protocol for the stack above it, and there are many competitive, emerging protocols where interoperability at the top layer is simultaneously important until a handful of core protocols remain. Moving forward we will be very mindful of how and to where value accretes across protocols and applications.

IS THE BUSINESS BUILT BY FOUNDERS ALIGNING INTERESTS OF TEAM AND INVESTORS?

Creating mechanics that promote alignment amongst constituents is crucial in any venture. Such mechanics may take the form of a token vesting schedule that can temper early liquidity (and hence volatility), or a contractual arrangement wherein investors can earn partial liquidity even before founders. Moving forward, we will likely see projects providing discounts or tranches of tokens set aside for ideal value chain partners (e.g., incentivizing Amazon to use a token by providing an upfront allotment). Without some form of alignment, risk can be far more difficult to gauge; transaction and price volatility post-launch can be unpredictable due frequently to ill-qualified and speculative investors.

Archetypes to Avoid

DAPPS THAT IGNORE THE VALUE OF CENTRALIZATION

A user-facing application does not necessarily benefit from completely decentralized management. If an app is totally decentralized and truly peer-to-peer, then its fees simply pay for transactions and compensate the peer who is selling or renting his or her product or service. If an app is more centralized, higher fees pay for added services such as account management, dispute management, technical and customer support, etc., that play an important role in improving the user experience and accelerating consumer adoption. Again we must be mindful of to where and to whom value accretes.

PUBLIC ICOS TO UNACCREDITED INVESTORS (PURE SPECULATION)

While a viable way to make money, we instead prefer private sales that are available to accredited investors. Financings are diligenced around team, business opportunity, and milestones – just like traditional equity investing at the pre-seed. Many ICOs appear to be founders declaring to the world how impressive their new economy will be, and raising $100M+ simply because they can and the ICOs are uncapped – versus validating the business case for their fundraise. We will not disregard the traditional professional investor.

While the ICO appears here to stay, it may be most suited to fund highly technical blockchain infrastructure projects that only a select group of developers on the vanguard can recognize. The immediate jump to an ICO is less appropriate in the case of a DApp, where a startup is an application with a use case that is clear to a traditional investor who can provide introductions and industry expertise, beyond capital.

RECENTRALIZATION FOR INVESTMENT

. . . or raising money through a token or coin offering for another centralized investment vehicle. For example, if someone is running a coin to buy property in Nicaragua and the token is not core to the business model, this is a red flag. The market already has this use case solved without blockchain.

UNNECESSARY REGULATORY UNCERTAINTY

We avoid tokens that will be visibly vulnerable to future regulation (and subject to potential national bans that could freeze cryptoassets), or those that are considered a security versus utility token (which most claim to be). At a recent ICO Financing Conference, the SEC representatives cited both the DAO Report and the Howey Test as the best ways to evaluate the SEC’s position as to whether a token would be deemed a security, yet this still leaves many questions unanswered. Adding another wrinkle, as venture capitalists start to invest in utility tokens, it could be construed as speculation given the fact that they do not plan to use the tokens (although the capital investment is necessary to create the token in the first place). Coinbase’s Securities Law Framework for Tokens covers the token sale bases of what we would expect companies to adhere to – at least until the SEC issues its next statement. All interesting developments that we will continue to monitor closely.

PRICING MODELS THAT INHERENTLY CLASH, OR TRADING INTO AND OUT OF ASSETS VALUED IN THE FIAT ECONOMY

When a fixed amount of coins are issued against a rising demand, there is a natural increase in value, as denominated against dollars (USD). But, when a third factor like transportation units are tethered to the blockchain token, then this third entity’s price is driven up when the token’s price is, despite that unit being priced in the real economy. Hence, in this example, there are two unrelated pricing dynamics at play. We could buy 1000 blockchain units, priced at purchase at 1 unit for $1, for a pallet shipment between San Francisco and Hong Kong in three months time. But, in the meantime the price of that token could triple to be worth $3000, and the market for that particular shipment could also have gone down as denominated in dollars (USD), to be worth $750; this service is also subject to a separate market denominated just in dollars. For advance utility purchases within the physical world, using a token isn't optimal. Instead, the freight booking can be made in fiat, and distributed bookkeeping can leverage the token.

Opportunity Areas

While international payments and cryptocurrency investments are the most established blockchain use cases so far, we are actively monitoring several budding opportunities.

Currency, Financial Infrastructure & Marketplaces

THE CORE INNOVATION: (BORDERLESS) MARKETS ARE AVAILABLE EVERY HOUR OF THE DAY, EVERY DAY OF THE WEEK

Blockchain can significantly reduce the cost and time to transact. Today, it takes close to three days to clear a stock trade because intermediaries (e.g., banks, escrows, and credit card companies) are needed, as the parties can’t access each other’s ledgers to verify the assets are owned and can be transferred. In a blockchain future, it will take minutes. Read more from Naval Ravikant on replacing networks with markets fueled by programmable digital assets, and big picture implications.

MARKETPLACES ARE RIPE FOR DISRUPTION, BUT DECENTRALIZED MARKETPLACES HAVE CHALLENGES

Open Bazaar is the eBay for decentralized e-commerce, and while the protocol charges no extra fees for users to transact, it will make money from value-added, centralized services that improve usability. Yet it is not yet clear what those services will be. Decentralized marketplaces that support the transfer of physical goods have a few challenges that are yet to be resolved, including the guarantee of actual physical transfer of the good once it’s exchanged over the blockchain. Another is the management of disputes, returns, and exchanges.

While marketplaces for physical goods have challenges, blockchain-based marketplaces for digital assets are not as technically troublesome. Notable examples include big data marketplaces such as the Ocean Protocol, whose goal is create a global supply chain of data for consumption by AIs. Ocean will empower data providers to control who (or what) accesses their data assets, as well as how or where the assets are being used.

Computing: Storage, Compute & Communications

WE ARE BULLISH ON APPLICATIONS THAT OPTIMIZE THE THREE ELEMENTS OF COMPUTING: STORAGE, COMPUTE, AND COMMUNICATIONS

This is particularly relevant as different forms of artificial intelligence increase storage and computing requirements with broader adoption. Filecoin, Storj, and Sia, which are systems to hierarchically store and manage large files, provide markets for users to rent their excess computer storage capacity to one another in exchange for a token. They can be considered “Airbnbs for file storage.” BitTorrent inventor Bram Cohen created the Chia Network, which will harness plentiful unused storage space on hard drives to verify its blockchain and make computing more eco-friendly. Furthermore, Golem allows users to rent computer processing power peer-to-peer to perform tasks like rendering; it automatically determines the number of machines and length of time needed from each for the task. And with Blockstack’s decentralized browser platform at the communication layer, users manage their identity data and token accounts, and circulate identity data and tokens to DApps for easy access all in one portal.

BLOCKCHAINS ENABLE THE STORAGE AND TRANSFER OF LARGE, STANDARDIZED DATA SETS WHICH CAN THEN INTERACT WITH MACHINE LEARNING MODELS OR ATTEST OWNERSHIP

The blockchain stack contains an incredible long-term data play. For private or consortium blockchains or those with an emphasis on privacy, data marketplaces offer a way to monetize user-owned data and establish the connection between data owners (like enterprises, and individuals) and data consumers (like AI startups). This involves tracking data in decentralized databases and then selling it to owners of machine learning algorithms who want to use it to train their models. The value here is opening up existing data silos and feeds to a marketplace where they can be monetized (e.g., by the Fitbit user). Example marketplaces include the Ocean Protocol that lays the technical foundation for data marketplaces, Enigma Catalyst for cryptomarkets, Datum for personal data, and DataBroker DAO for IoT data streams.

Public blockchains could provide the single largest repository of validated records. As more digital assets are stored and traded, these records will extend to anything physical or digital with value, and will include land registries, property records, tickets, and more. The value here is tracking data in an immutable and secure way, across generations.

Supply Chain

APPLYING BLOCKCHAIN TO SUPPLY CHAIN IS PROMISING, BUT HAS CRITICAL CHALLENGES THAT MUST BE ADDRESSED WHEN IMPLEMENTED

Key challenges for all supply chain use cases include convincing risk-averse companies to change their complex processes; unifying multi-company participants with different pricing and incentives to the same digital thread (or simply getting to the “walk phase,”); and, successfully tying the chain to physical assets. Two promising use cases are handling document exchange and management, and dispute reconciliation. Maersk is a prominent example of a company testing blockchain to track shipping cargo and freight movement while improving the process of managing shipment documents. WaveBL and Authenticiti are two startups focused on supply chain digitization and paperless trade.

Companies can already track the movement of a physical good by registering its digital identity on the blockchain, providing much-needed transparency to the system. The good can be tagged with a tamper-proof device such as an RFID, and each time the good moves in the supply chain, the device is scanned and the digital counterpart is updated on the ledger. However, critical challenges remain, including the need to have a reliable and tamper-proof tag to begin, adapting operations to a new process, and building technological trust at the end points (such as the moment when the manufacturer first produces the good and assigns it a digital identity).

Trade financing, the third major use case, can be improved on the blockchain as well. Hijro, a company in supply chain finance, connects banks, buyers, and suppliers across one network designed to streamline and automate settlement, reduce fraud risk, and break down costly data silos. Sweetbridge, a high-profile team focused on trade finance, is attempting to free up working capital by providing discounted financing against cryptoassets, with the goal to extend to traditional asset classes.

Identity and Personal Data

SELF-SOVEREIGN IDENTITY WILL BE A GAME CHANGER...ONE DAY

Citizen-facing government agencies are still required to adopt identification methods and vouch for an individual, and so will need to be the first adopters surrounding this use case. One step toward that future is Evernym, a company that created an open source global public utility, Sovrin, for the decentralized exchange of verifiable claims (the State of Illinois recently partnered to store birth certificates on the platform). Another step toward a government verified digital identity is happening in Zug, Switzerland, also known as “Crypto Valley,” which kicked off an identity project in September 2017 and now offers citizens a digital identity on Ethereum.

Futuristic Potential Applications

PAY CLOSE ATTENTION TO SOLUTIONS THAT ENABLE INTEROPERABILITY

New blockchain platforms built from the ground up are emerging daily. Cross-blockchain interaction contained within a single end-user interface will one day be possible with emerging solutions like Cosmos, Polkadot and Ripple’s Interledger Protocol (ILP). To illustrate the concept, the ILP aspires to offer an “internet of value” with value being sent at the speed of the internet, designed for interoperability between blockchain ledgers. (As a non-blockchain example today, a user can’t send money from PayPal to Venmo as they don’t share a bank in common.)

THE STABLECOIN CONCEPT IS IN ITS INFANCY, AND OFFERS ONE SOLUTION TO VOLATILITY

New tokens like Basecoin are creating a future where a protocol can be pegged to the value of an asset via a decentralized autonomous organization (DAO) monitoring exchange rates and adjusting token supply, minimizing volatility. This has been called the "holy grail" of cryptocurrency. While creative, this may be a technical solution to what is in fact an economic problem. For Bitcoin investors with deep pockets, it is a way to reduce Bitcoin exposure and increase dollar exposure without having to deal with the dollar system directly.

Looking Ahead

We believe that the current blockchain environment is a rallying cry for innovation to overcome its current limitations and realign value. As with any nascent technology, the most immediate challenges ahead lie with scalability, infrastructure, regulation, and defining an acceptable user experience. It is critical that we, as a frontier curve investor, fully understand our risk tolerances – private blockchains are backed by incumbents in their respective industries solving for efficiency, while public blockchains are backed by disruptors creating a new (and risky) asset class. We are in a bubble, driven by retail and institutional investors alike.

It is our contention that blockchain is analogous to email for money and that it represents the biggest upheaval in the internet since the Mosaic browser. While investors must smarten up with improved diligence, given the widespread low caliber of user interface and experience, user adoption will remain an enormous hurdle (akin to 1993). After a historic year filled with frothy ICO fundraises and corporate blockchain experimentation, we look forward to the first killer DApps going live in 2018 and the inevitable marketing leveling that will occur.

At Bee Partners, we will remain disciplined in our due diligence to unlock the massive potential of this new economy amidst the development of ever more complex and novel blockchain use cases. We commit to recognizing and embracing the power of interoperable applications, users, and connected devices to transform markets and restructure the fundamentals of doing business.

Kira Noodleman

Principal, Bee Partners

kira@beepartners.vc

Garrett Goldberg

Partner, Bee Partners

garrett@beepartners.vc

No Comments.