A Consumer-Driven Stack

Introduction

The growth of the on-demand economy (from 41.5m to 56m U.S. consumers in 2018) is transforming supply chains globally like never before. Fast-moving consumer goods that once took days to arrive are now expected in hours or even minutes. Status visibility, product authenticity, and receipt optionality are no longer premium service offerings, they are the baseline standard. Route efficiencies are being optimized through artificial intelligence, delivery density increased through semi-automated solutions, and recipient convenience enhanced through delivery aggregation/collection options.

As global investment into logistics startups continues to rise (from $3.2b to $6b in 2018), as adoption of new tech by large commerce incumbents accelerates, and as consumers demand even more instant gratification, the pace of sector evolution is set to continue. The real question, though, is where is the next set of opportunities for Founders and investors as the logistics tech wave builds? Will the wave break as leaders emerge and consolidate and/or will a new wave form, one focused on new solution layers? What are the residual pain points in logistics and how will they be solved?

To explore these questions further, we will discuss:

- Logistics as a Consumer-Driven Stack

- End-to-End Industry Challenges

- Shifting Traits and Archetypes to Avoid

- The Future and Opportunity Areas Moving Forward

The Consumer-Driven-Logistics Stack

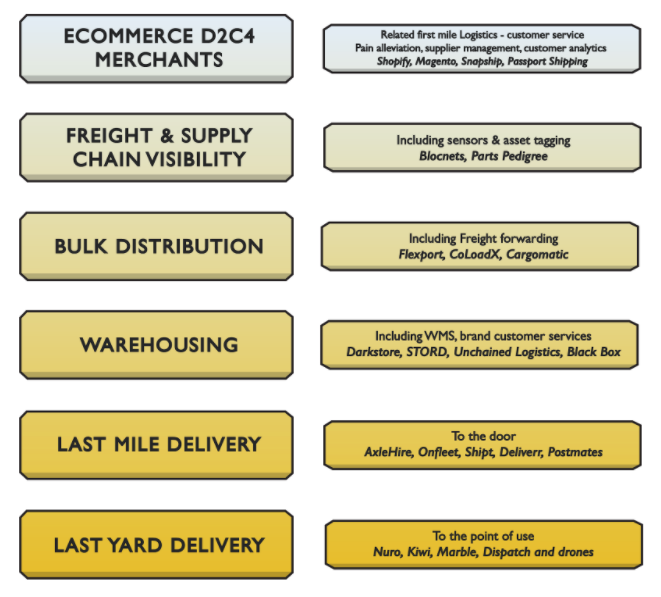

At Bee Partners, we often describe technology investment vectors as being constructed as a “stack,” and how we must maintain discipline when investing in layers of the respective stacks. This value chain framework illustrates how market participants sit relative to each other in order to deliver customer solutions.

Some participants are foundational, others aggregate layers over time or squeeze into the white space between. Still others use new technology to expand or foundationally shift the stack. But what is clear is that the new entrants, both on the customer and solution provider sides, constantly force an evolution of the stack, resulting in a realignment of the value chain and in turn, creating significant opportunities at different levels and at different times.

Below is our current construct of the consumer-driven logistics stack, highlighting the different investable elements of the value chain as we currently see them. By no means comprehensive, like the evolving stack itself, the construct is intentionally malleable, allowing for future additions and aggregations.

At Bee we often use the term enabling technologies to describe how a technological breakthrough (or new combination of technologies) enables an entire new industry, or in this case will enable a new addition to, or aggregation of, the stack. Enabling technologies also eliminate certain types of risk, which is essential to this transformation. As the ecosystem evolves, we predict boundary adjustments, fragmentation, consolidation, and even new layers. Below, we offer a few areas of challenges and opportunities for investment, as well as the intersecting traits we seek given our pre-Seed focus here at Bee Partners.

Industry Challenges

Forever Downward Pressure on Margins - Logistics is a necessary condition in transferring atoms from the seller to the buyer. And while the seller wants to increase their own margins, the buyer wants to lower their own costs. This inherently inflicts constant pressure on margins, forcing some companies to internalize parts of the logistics stack, often unsuccessfully. Of note, 11 percent of total sales revenue is still attributed to logistics costs.

Asset-Heav(ier) Models - Someone still has to take physical ownership, and packages need to be delivered in a machine (airplane, car, robot). Further, many of the legacy software systems are clunky, overpowered, and require significant upfront investment in cash and engineering, effectively an asset-heavy piece of software.

Cash Flow - Many opportunities, especially at the last mile and those with low margins, require significant liquid cash flow to fuel growth and finance driver and other payment timing. There is also a lack of margin to afford credit financing, and obtaining this credit adds pressure to the earliest of startups.

Complexity of Systems - 1:1 is easy, but as soon as a company starts introducing many-to-many, things become increasingly complex. Based on Metcalfe’s Law, which states that the effect of a network is proportional to the square of the number of connected users, a logistics network with only 100 nodes would have 10,000 direct pathways to manage. Software-assisted management is the only viable option.

Paring Technology with Density - There is a natural tendency for the larger players to consolidate layers in the stack and subsequently raise prices. It’s only through technology that the hurdle cost of starting a new business in the same space to take some of that margin is overcome, providing downward pressure on rates. These rates remain low if the required scale and density is achieved, which can sometimes be counterproductive to long-run increasing pricing power.

The Last Mile (including the Last Yard) - This area remains a battleground for retailers with notoriously thin margins. The original traveling salesman challenge represents up to 53 percent of the cost to deliver a package, and a robust tech stack is required to compete. This is perhaps the hardest problem to solve in logistics, currently dominated by legacy carriers with huge infrastructure and union labor costs, yet who are necessarily reliable in the eyes of their customers. Moving forward, retailers whose business models cater to online delivery while minimizing last-mile costs will be at an advantage.

Physical machines are increasingly entering the last-mile discussion, but must master the last yard that humans have owned for millennia. A drone “drop” must hit its target (gently), while a ground-based robot must cognitively be able to step up to the porch while avoiding the dog. Further, once implemented, how far up the stack can these machines go? Getting this to mainstream use will take several versions, but we expect it to be very disruptive. See this article for more depth on how leveraging key emerging technologies will enable cost reductions over the last mile in the near future.

Well-Funded Competition - Anyone from Uber and Postmates to XPO Logistics and UPS are constantly undertaking strategic initiatives (and shutting others down) on many fronts. This has and will include acquisitions, acquihires, and ruthless competitive tactics, with XPO Logistics alone already having made 16 acquisitions; UPS now has launched two competing services, UPS eFulfillment and UPS Ware2Go. Put another way, new entrants should join the battle with their eyes wide open.

Traits to Consider

Shifting Consumer Demands - A main thesis of this paper is that consumers now expect products to arrive at their front door or even more intimately into the building. This has manifested across food boxes (Blue Apron, Imperfect Produce), clothing (Stitch Fix), consumer staples (Instacart, Walmart), and more to come. More than 70 percent of shippers and third-party logistics (3PL) operators recognize the need for last-yard services as the next step beyond last-mile delivery, including food going from the front door to the fridge. Startups have the opportunity to capture market share as a result of these shifts, but must move quickly and with modern products before incumbents close the gaps.

Shifting Merchant Base to Match - Merchants are shifting their playbooks to match, resulting in an explosion of D2C merchants, creating a long tail. They must now support ever more complex operations with a curated customer service model, no matter who the customer. HelloFresh and Dollar Shave Club lead the way here, while certain verticals (cannabis, for example) have their own logistics stack and customer-support challenges. Logistics companies must be mindful of how they cater to these new companies, and new entrants can take advantage of the resulting friction.

- Integrated Logistics - Integrating deeper with customers yields sales victories and sticky accounts. Effective integration can range from something as (deceptively) simple as label printing to tasks as truly complex as handling line hauls for the last mile. Integration could include extending the last mile up the stack, or getting inside the point-of-sale system. However, it gets increasingly complicated as one begins to manage things like parcel expiration or driver coordination. Shippo, EasyPost, and AxleHire are leading the way here by providing more services to their clients, sometimes at increased pricing.

Access to Mobility Pools - Driver pools are plain hard to manage, and must come with scalability and de-scalability. Can an AxleHire or Postmates compete with Lyft, Uber, or Amazon for driver talent, particularly as a shortage of truck drivers continues to grow (from 60,000 in 2018 to a forecast 175,000 driver shortage by 2026)? And when will they become completely obsolete as machines win? In 10 years or 100?

Stack Cycling - The business model is always under threat, and stack borders can be fluid. There is a constant desire for new entrants to either aggregate or disaggregate layers, so where do we sit in the macro cycling? Is our place in the stack being consolidated by others or is an e-commerce trend creating a white space? Or are customers currently willing to pay a higher price for a better customer experience and user interfaces? Any new entrant must consider if now is a time to be a meta layer, or fill a specific white space.

Driving Down the Relevant Economic-Handling Unit - This is a must, whether that cost unit is sortation for a last-mile company, physical parcel handling, or handling customer service requests from warehouses, e-commerce companies, or shippers. Logistics is all about maximizing throughput and processability, while lowering complexity and enabling the merchant to store inventory closer to their customer… all while providing a branded delivery experience.

Archetypes We Will Avoid

Lack of Adjacency - This is a stack after all, both hardware and software, with dependencies on other parts of the chain. Stand-alone solutions will be difficult unless they solve a problem entirely, and/or have massive scale capabilities.

Businesses Without Positive Margin-Network Effects - While seemingly an obvious statement, network effects should have a deflationary effect on internal costs, allowing for margin expansion. Sales should become easier on each side of the marketplace, allowing the startup to grow with customers (new locations, new services) and further allowing them to onboard new customers.

Investment-Heavy Onboarding - Startups must be able to walk into any facility or onboard any customer without major investment, while allowing customization and interoperability on a number of levels.

Purely Favoring Technology > Customer Service - As merchants grow, customer expectations increase, making it ever harder for the merchant to manage customer service without outsourcing, which usually comes with customer service. We will pay special attention to the opportunities created when competitors take their eyes off the most important ball, customer satisfaction.

Opportunity Areas Moving Forward

Augmenting, Disintermediating, or Otherwise Becoming a 3PL - Long an area of consolidation and margin compression, 3PLs are gaining importance as the stack shifts in a D2C direction. There are many forms a tech-enabled opportunity could take here; STORD and Flexe provide good examples.

Solutions Leveraging the Shifting D2C E-commerce Landscape - D2C logistics is an accessible and massive opportunity area from a pre-Seed investment standpoint that’s been growing at a 15 percent CAGR. Omnichannel platforms such as Ordergroove that enable customer relationships to be nurtured across multiple digital touch points are only reinforcing this shift. But how can venture capital be effective in supporting further opportunities for delivering on the D2C promise? Transforming the D2C logistics pathway from one of commodity transactions to one of customer engagements may be one solution focus. Would this also influence how shipping returns (reverse logistics) will play out?

Intelligent API Business Models - A 4PL that acts as an API between merchant, 3PL and carrier has real potential to reduce connection and growth friction for the benefit of the whole stack. And should it be effective, it can continue to service the customers much further into their growth curve. Unchained Logistics has this potential.

Chaining up the Stack - This includes lining up or aggregating parts of the stack to compete with vertically integrated giants. CommonSense Robotics is taking one approach by building a network of local, automated and scalable sites to enable profitable one-hour online deliveries, while 5PLs take another, focusing on supply networks (vs. supply chains).

Micro-Fulfillment Centers - Tiny, urban warehouses that (often autonomously) fulfill online orders are beginning to manifest, often in smaller-format urban stores for the larger chains. Can companies like Darkstore or CommonSense Robotics find a sustainable foothold and keep customers happy?

Elusive Full Autonomy - While last-mile robotics remains a hot area of investment, true functionality and customer satisfaction remain elusive here. Nuro has an interesting take on aggregating layers in this stack while Berkeley-based Kiwi has simplified the stack by taking a campus-limited focus. However, on-street autonomous systems still have many practical challenges. This will surely be worthy of a deeper dive in the future, especially as we consider drone delivery and the “last yard.”

Lastly, A Note on the Blockchain

Distributed ledger technology (DLT) is sexy right now, but it is not going to revolutionize global supply chain processes until stronger bridges between the digital and physical worlds are created (for example, IoT sensors). This is because without these bridges, participants must trust each other within the current system while concurrently adopting a technology whose primary value proposition is the ability to function without trust. Once these bridges are built, they can then trust the DLT-based system and blockchain can arrive.

Digitization of the flow of information (for use cases like document exchange and dispute reconciliation) across a supply chain is the lowest-hanging fruit, as the use of electronic data interchanges (EDIs) and similar tools represent as much as 20 percent of the total cost of global supply chains.

Once there is a single source of truth, companies can track the flow of physical goods by registering their digital identity on the blockchain. To bridge the analog gap, unique identifiers like data matrices coding will work with unique goods like diamonds, but cannot be applied to more commoditized goods, like apples. IoT sensors perhaps provide the best method, but cost more than alternatives and may require battery and/or a power source, which could draw security concerns.

Trade financing and the flow of capital, the third major use case, is currently the most difficult supply chain application; “end-to-end” start-up solutions should aim to fill in white spaces left by incumbents (or example, SMEs whom the banks don’t currently service). For more of our thoughts on blockchain, see our Blockchain Industry Insight.

Conclusion

The key to success in logistics is making it as easy as possible for your customers to service their customers. When combined, fewer fiascos, less friction down the chain, and more invisible technologies all must result in a truly curated customer-service model. Reputation remains important, and yet startups must still service individual customer needs and processes at scale.

Further, at what point will the "last mile" be not just about route-optimization algorithms and crowdsourcing models, but also about enabling delivery technology (think reliable object recognition even in low visibility conditions to enable fully autonomous delivery vehicles) or enabling multiple delivery technologies (think dynamic control across drones, vehicles and robots to enable multi-modal last-mile or even last-yard delivery)? Further, when will the last mile extend further up the chain to incorporate more of the stack, potentially allowing these players to charge more for the convenience like FedEx has done for years?

There is scope for another layer in the stack on the recipient side. With the number of last-mile carriers emerging, might it be beneficial to aggregate deliveries from multiple carriers in a single time slot, place, drone hub, etc., of convenience? AI could surely help to define this through calendar access, last-yard identification, or other. And will carrier APIs open up to allow this efficiently in exchange for customer feedback? Or … what happens when home 3D printers become ubiquitous and only raw materials must be delivered?

Lastly, will mass market delivery ultimately be a race to the bottom on margins (think CPG via Amazon), or will more focused delivery categories find and hold on to their place in the stack (think emergency delivery such as drone delivery of defibrillators, buoyancy devices, or fresh produce)? Exciting logistics startups represent the answers to these questions.

Garrett Goldberg

Partner, Bee Partners

garrett@beepartners.vc

Brent Watts

Associate, Bee Partners

brent@beepartners.vc

No Comments.