Image: Crunchbase

Blog by Ale Vergara | original post can be found on Medium

While in Chile for Christmas, I took the opportunity to reconnect with the startup ecosystem. I borrowed my mom’s commuter bike and rode all around Santiago at the peak of summer heat and holiday traffic. I sat down with twelve Founders and Investors to get a better understanding of what’s happened in the last two years and what they believe the next two might look like.

The short answer is that Covid-19 uncovered the reality of most businesses in Chile and Latam: outdated legacy systems, a lack of interoperability, and beyond all, a very low penetration of digital operation. Fast forward two years into a pandemic, and so much has changed in financial services, healthcare, logistics, e-commerce, and many other sectors.

Through these conversations I doubled down on why now is the time to invest and what’s next.

Spoiler alert: it’s all about the “regional” Founder mentality.

Image: Medium

Latam B2B software: why now?

#1 Market Dynamics: software is eating the world in Latam, and even after the massive digital update companies were forced to undergo as a result of Covid-19, B2B software solutions remain scarce. B2B in Latam trails B2C, but the gap is closing fast. According to MarketWatch, Latam B2B SaaS will grow at a CAGR of ~25% in the next four years, a trend that mirrors the early days of Silicon Valley.

What’s different?

A maturing ecosystem in fintech and e-commerce, that’s sparked a new wave of regional startups providing turnkey solutions catering to these industries. The result? A faster pace of innovation and a consolidation of true networks across frontiers, making B2B software in Latam investable.

#2 ROI: Companies making a dent are those freeing up resources tied to their customers’ operation (especially those with high fixed costs). By doing so, these software businesses allow their business customers to focus on core competencies, while increasing resilience in the face of an economic downturn or an unexpected shock. In other words, these third party solutions help not only cut down costs impacting the bottom line, but actually free up resources that can be reallocated, impacting the top-line. Plutto for example, is saving their customers time and money on KYB (Know Your Business), reducing onboarding time from months to days, while freeing up time to onboard more clients in less time: a crucial component for the success of any fintech company. More interestingly though, Plutto is gathering much more than traditional data points on companies, which can eventually provide the necessary risk analysis for its clients to serve more businesses than they ever thought possible.

By digitizing (and automating) processes that collect and analyze data, and create actionable insights, businesses can focus on what’s important today and more accurately plan for scale in the future. Toku is doing exactly that with recurring payment collection for B2C companies. The ROI? A 96% decrease on involuntary churn and reduced payment fees by 82%². Reversso, is another example, optimizing return and exchange processes for e-commerce. In Chile and other parts of Latam, returning items isn’t free, so not only does the ROI come from reduced operational costs, but also from increased revenue thanks to differentiation and a higher-touch with the consumer. Again, it’s a positive impact on bottom and top-line profitability.

For North American readers, all of this might sound like “it’s been done before”, but Latam local players have a competitive advantage: language and culture, market familiarity, and more importantly the ability to navigate the regulatory frameworks of disparate regional markets. As Janan Knust, Founder of Klog puts it, “You need the experience and the knowledge [of each individual market in Latam]…this is why Flexport and Forto are not here. Because there are so many countries, cultures, customs differences. You need to be an internal person to understand how this works, and then digitalize.”³

#3 Human Capital: Talent is high quality while still affordable, though the salary gap is closing as we speak. One of the reasons I left a more traditional career path in 2019 was because I saw a massive talent shift: the best graduates from Chile’s top universities were not all flooding into Investment Banking or Consulting as had been the case in prior years. Many were choosing jobs in Tech and Startups, while others like myself were making career pivots to join the movement. The arrival of Big Tech in Chile (Microsoft, Oracle, Google, AWS) and early success stories of co-founding teams (NotCo, Fintual, Betterfly) generated momentum and a trail blaze for aspiring entrepreneurs and developers.

A side note on Chile: Santiago, Chile’s capital, has the third largest pool⁴ of digital talent in Latam, only outnumbered by Sao Paulo and Mexico City, both of which have more than three times the population⁵. Additionally, policies such as the Digital Economy Partnership Agreement, signed by Chile, New Zealand and Singapore have increased foreign companies’ scouting efforts. As a result, developer salaries rose by 40% during 2020 and those employed locally have seen their numbers double in the last six years⁶.

University students are also in the spotlight. Last year, one of Chile’s largest retail and grocery multinationals, sought help from Computer Science undergrads at Universidad Catolica for their dark store⁷strategy. As a result of Covid, demand for grocery delivery skyrocketed and suddenly, convenient locations and arrangements, rather than beautifully organized aisles and stands became a priority. This demanded the company rethink their stores’ frontend and backend. Students were tasked with redesigning and rearchitecting the company’s software stack into one connected system–one of my younger brother’s favorite and most challenging projects in school thus far. To put into perspective the importance of finding the right talent to solve this, more than 50% of current e-commerce sales (even with the worst of the pandemic behind us) are fulfilled in these dark stores, a trend that shows no signs of slowing down.

Photo: Destinations Guide

What comes next?

Most Latam B2B SaaS companies provide horizontal solutions, serving a plethora of enterprise and SMB clients. B2B software in the region is “in a phase of construction, not optimization”, mentioned Antonia (CEO of Plutto) in one of our conversations. The pandemic evidently accelerated this process: companies now look at external providers (rather than building in-house) for the digital solutions they need and a lot more attention is given to IT departments. To add on, the rise of Shadow IT⁸ is accelerating adoption of novel solutions even further. With security and compliance considerations in mind, this is definitely a step in the right direction.

Horizontal solutions abound because there are still multiple opportunities. Despite the global nature of pioneers, their localized products are not capturing the full market. Cristina’s example (CEO of Toku) makes it clear: in Mexico, 20% of payment transactions using Stripe get rejected. Toku solves this problem in a holistic way, implementing a routing and cascading strategy first, and from there, layering additional products and services to increase value for their customers.

As seen in mature markets, these opportunities are limited and increasingly, incoming players will focus on specific industry verticals or niche customer segments, providing a core software solution with multi-layer upselling potential. Latam might need more robust infrastructure for Vertical SaaS to flourish (it’s happening), but the main reason we’re not seeing this is opportunity cost. As it gets increasingly more difficult to compete in horizontal markets, we’ll see more vertical players arise, becoming market leaders in industries that have been left behind. Some early green shoots include: isaac, streamlining school fee payment and management in Brazil and Comunidad Feliz, administering buildings and condominiums in Chile and Mexico.

Further, a maturing SaaS business ecosystem will unveil the opportunity to serve these companies, their users, and employees in turn. As an example, developer platforms with a vertical focus, will increasingly facilitate payments and data sharing in fintech, e-commerce and healthcare. More on this below.

Infrastructure: why now?

As mentioned at the beginning, compared to developed markets where there is a lot of tech infrastructure to support new businesses, many Latam B2B founders have built their solutions full-stack. In other words, before they could think about fulfilling their vision for “better, faster delivery” (or any other), they needed to design and build for supplier business identity verification.

It’s worth noting that things are changing, as tech infrastructure becomes increasingly borderless. As we saw with B2C businesses in the region, the explosive growth was enabled by US-based infrastructure. However, gaps in technologies like OCR⁹ and a lack of local data sources and integrations, make localization of US products imperfect to say the least.

Local players are (1) taking notice of the tech gaps and (2) expanding their horizons. It’s no longer about building for a specific country, it’s about building for the Latam Region as a whole. These founders are building companies that provide secure and compliant access to user data via APIs and enable faster, better customer-centric product innovation.

A lot of these companies are focusing on the pain points of fintechs, providing them not just with a better value proposition, but with a much more scalable one across the region.

YC Latam Founder & Funder event at Bee Partners Office 9/9/22

Fintech Infrastructure: solving for the region

Fintech in Latam received over 40% of VC funding for the region in 2021¹⁰ (LAVCA), but there is still a lot of room for innovation. Fintech companies have been built on top of fragmented, stodgy infrastructure accompanied by regulatory and technical hurdles. One question all early stage founders get from potential investors is how they’re thinking/building for regional expansion, because to a greater/lesser extent, all Latam founders have to start fresh when they cross borders.

For a country like Chile, with a population of roughly 19 million, expanding into neighboring countries is necessary, but it’s not easy. In the case of fintechs, considerations around new currencies, new actors in the respective financial system, new data sources, all on top of differing levels of digitization and economic stability, make speed-to-market very challenging.

Gueno saw this early on, which is why they decided to solve onboarding and compliance for web2 and web3 with a regional mindset from the get go. They realized there’s two big hurdles for US/European based companies to do onboarding/compliance in the region: (1) the existing integrations with Welsfargo, Coinbase, Finicity, SSN, phone numbers don’t work, and (2) Integrations with the local data sources don’t exist. Gueno is filling the gap for the region, allowing for “real time, risk based decisioning under one API”¹¹.

The story repeats itself when we look at innovations around Open Banking¹², which is providing banks with a secure way to share customer data with third party providers. Fintoc allows developers of user-facing apps to connect with their clients’ financial institutions in a safe manner. Through this connection, developers can improve on their app’s accessibility and ease of use. Fintoc provides lenders the data they need to develop better user risk profiles, SMBs the data needed for bank reconciliation, and fintech companies the data they need to best serve their customers.

In Latam Plaid isn’t enough because to serve customers, fintech companies need more data and from different data sources than just financial institutions (e-wallets, gig economy app accounts, etc). Let’s not forget different data privacy regulations and varying degrees of under and unbanked populations.

When it comes to Latam-specific problems and solutions, Pomelo stands out as an incredible enabler. Pomelo is a digital payment processing platform that allows fintech and embedded finance companies to launch virtual accounts and issue debit and credit cards. For a country like Chile, the presence of a player like this is a game-changer. An affordable white glove solution that can simultaneously integrate collection and payments across regions and currencies, help them launch new services like credit cards, and connect virtual accounts to local financial systems lifts a massive burden. Without it, every time a company wants to operate in a new country, they’re back at square one.

What comes next?

The presence of companies like the ones mentioned above, are changing the fintech landscape. By providing transparency and access to consumer data as Fintoc does, what we might have previously thought of as a standalone business, like a buy-now-pay-later app, suddenly seems more like a product in a larger digital financial services company. Consolidation of multiple services targeting niche markets seems imminent.

Additionally, a stronger move towards digital currencies and blockchain-based infrastructure will happen, though it’s still a matter of when. As I mentioned earlier, the infrastructure that our financial system sits on needs updating: it’s still slow, expensive and it’s not programmable. A company working towards this future is Shinkansen, proposing instant liquidity Clearing Houses and connecting them across borders. The company offers fintechs an easier and cheaper way to connect to account-to-account payment rails such as bank transfers. This matters because a company like Shinkansen can innovate faster than bank associations for base layer features needed by fintechs and B2B startups using such rails. This is relevant for B2B payments, and for consumer payments in countries where card networks are weak.

A regional account-to-account payment network layered on top of modernized local infrastructure might well be the key to jump into the next phase: programmable money for the region.

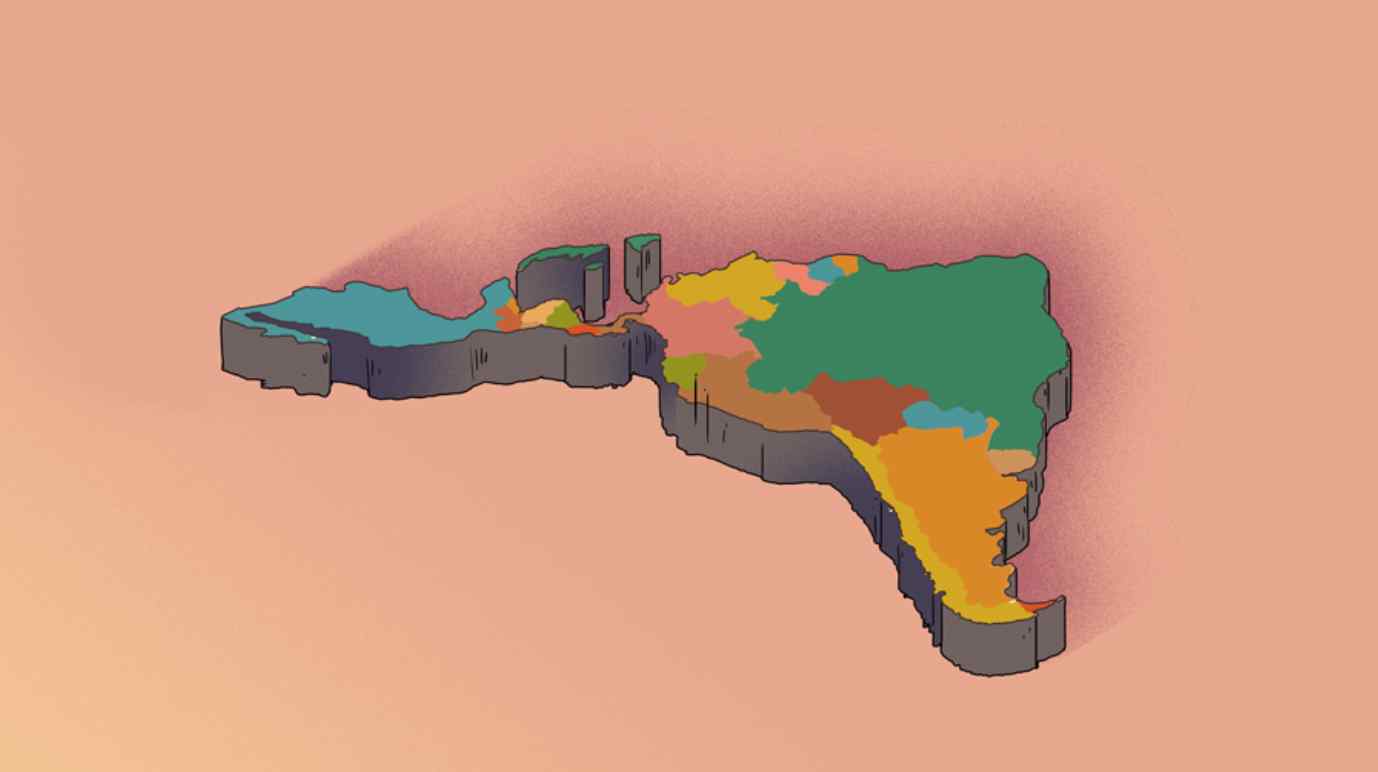

Image: Atlantic Council

Parting Thoughts

Covid was the catalyst, but a stronger force was signaling “winds of change”: a new breed of Founders, who have a regional mindset and who are driven to solve hard problems across Latin America: a region with a population of 667 million and a combined GDP of ~US$ 6 trillion¹³.

It’s no longer about the individual countries. These founders are thinking big from inception, and it’s reflected in the technical infrastructure they adopt, the teams they form, and the visions they have. Latam Founders are faster, better, stronger and I couldn’t be more bullish.

. . .

I want to thank Andres Baehr (Engie Factory), Antonia Rojas (ALLVP), Antonia San Martin (Plutto), Bernardita Araya (CMPC Ventures), Camilo Contreras & Camilo Flores (Inti-tech), Cristina Etcheberry (Toku), Santiago Lira (Buk), Leo Soto (Shinkansen), Markus Schreyer (Ganesha Labs), Martín Jofré and Rafael Meruane (CryptoMarket), Monica Saggioro (Maya Capital), Patrick Alex (Endeavor), Paula Enei (Platanus Ventures), Tomás (Gueno) for taking the time to discuss and everyone else who helped me with quick edits.

[4]https://blog.investchile.gob.cl/chile-latin-american-tech-hub

[5]https://es.statista.com/estadisticas/1192117/ciudades-sudamericanas-mas-pobladas/

[6]https://nearshoreamericas.com/chile-tech-deficit-salaries/

[8]https://en.wikipedia.org/wiki/Shadow_IT

[9]https://viso.ai/computer-vision/optical-character-recognition-ocr/

[10]https://www.lavca.org/industry-data/lavcas-2021-review-of-tech-investment-in-latin-america/

[12]https://www.openbankingexcellence.org/blog/the-state-of-open-finance-in-chile/

[13]https://data.worldbank.org/indicator/NY.GDP.MKTP.CD?locations=ZJ

No Comments.