Three years ago the Bee Partners team fully articulated our core investment thesis: we believe machines will win. This idea could be taken as dystopian or alarming. But we assert that the future doesn’t have to take a dark turn. How machines will win can – and is – up to us.

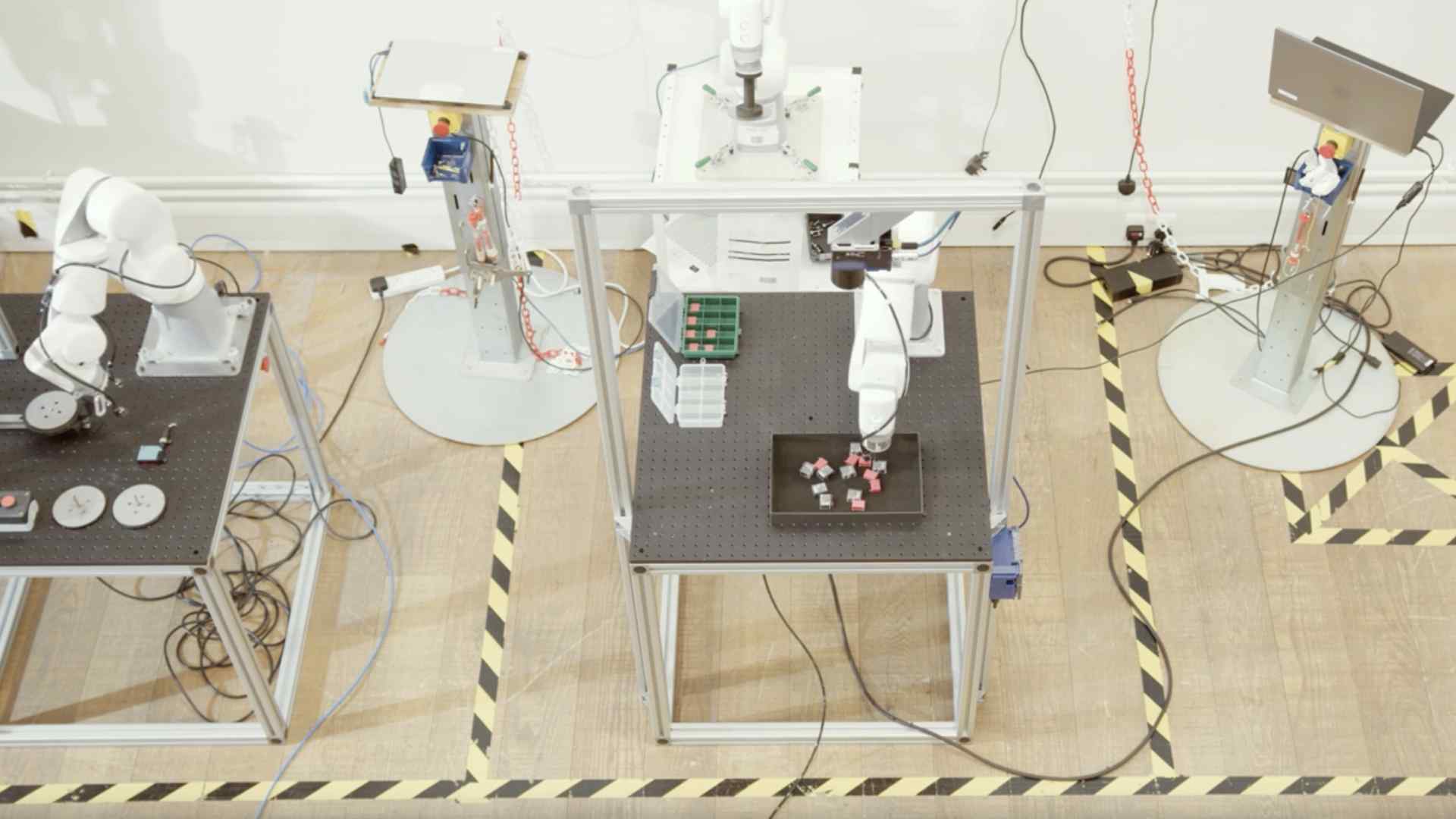

The thoughtful, dedicated founders in Bee Partners’ portfolio, and the investors who support their work, are positively influencing a machine-enabled future every day. In this world we are building together, machines have assumed the dull, dangerous and dirty tasks humans have labored over for so long, as well as complicated work that can take a long time to complete. Turning these jobs over to machines is freeing up humanity to dive deeper into the creative, ethical, intuitive and original aspects of our work that drive more innovation and create greater work satisfaction.

It’s easy to say that our “machines will win” philosophy guides our investment strategies at Bee Partners. But what does that look like when applied to the day-to-day? How will machines and the people who build them increasingly lead the charge in creating a better future for us all? Essentially, we need to remove more humans from the loop more often and enable machines to learn from each other.

What is Machine-to-Machine Learning?

When machines develop the capacity to improve without human engagement, we refer to it as machine-to-machine learning, or M2ML. We view M2ML as critical to a machine-enabled future, and our portfolio companies that are applying this principle are accelerating product, process, and growth while reducing the need for human involvement and effort to be successful.

M2ML isn’t just limited to digital domains. It is also being applied to physical domains, including manufacturing; M2ML is driving the acceleration of the Fourth Industrial Revolution (aka industry 4.0). It also extends to non-manufacturing physical industries such as tech bio, carbon tech, and agriculture.

M2ML’s Waves of Innovation

The application ofM2ML, which transpires across waves, can be useful at three different stages in a company’s growth:

- Wave 1: Concept (what a company could be)

- Wave 2: MVP Building (what a company should be)

- Wave 3: Go-to-Market (what a company will be)

Waves are a construct for reimagining innovation and market entry from soup to nuts. They can also allow us to rethink how we currently do things as we apply better-faster-smarter solutions in the machine-enabled future.

Wave One

In the concept stage, teams define which processes could be automated by looking for those that are clearly repeatable and/or that are currently manual and/or that facilitate discovery. Several archetypal industries and trends in particular benefit from W1 improvement. They include structured environments; industries undergoing newly realigned incentive structures; and businesses that rely on analog processes and, often, siloes of industry knowledge.

Knowde, is a Bee Partners portfolio company that set out to change how chemicals are bought and sold. They successfully applied M2ML’s first wave and dreamed up an online marketplace that would not only shift the repeatable tedium of selling from paper Rolodex cards to a marketplace of online stores, but also make it possible to surface and share decades of siloed industry knowledge more democratically. (Knowde successfully raced through M2ML’s 3 waves and has gained significant and rapid traction in the market.)

Wave Two

When creating a minimum viable product (MVP), many solutions can be built. W2 elegantly answers the question of whether they should be built by supporting rapid prototyping to test assumptions and break an idea as quickly as possible. The outcome of applying W2 innovation can be so significant it often leads to a redirection of original company intent.

Some companies that leverage W2 innovation include those balancing off-the-shelf and custom-built solutions; companies harnessing novel data sources and applying them to augment system performance; and companies engineering a bio-process based on an already-proven scientific breakthrough.

When Bee Partners portfolio company Future Fields [link to Syn Bio blog] went through their W2 process, they made adjustments to both their business-model and ROI expectations along the way. Originally, the team had focused on growing lab-made chicken. With W2 prototyping, they discovered the true costs bound up in that pursuit. Because of the price of the medium necessary to grow their product in the lab, creating one nugget-sized bite of chicken wound up costing thousands of dollars. Wisely, they shifted to creating an affordable version of the pricey medium used to grow their product and former competitors are now their customers.

Wave Three

W3 takes the lessons of the previous two waves and applies them to effectively land in market, and from there multiply growth and production while extending the knowledge gathered from product-market-fit (PMF) success to potentially create new products or expand into new verticals. This market-size multiplier of platform plays is why we find W3 so compelling.

Likely archetypes include companies that enrich and mix data sets; companies that succeed via network effects; and those leveraging an as-a-service (aaS) business model.

Bee Portfolio company Rapid Robotics, [link to Rapi Robotics blog] embodies several W3 archetypes. Leveraging robotics-as-a-service, the company originally set out to build an affordable robotic arm to conduct the repeatable machine tasks necessary in many manufacturing plants. Prototyping undertaken in Wave 2 informed Rapid’s W3 go-to-market strategy with a production-ready robotic solution refined by customer feedback. It also surfaced opportunities for horizontal extension into new task solutions. When Rapid applied the learnings of its machines in action, they saw they could grow the company from one that builds a task-management solution to one that provides a task-management platform. The more tasks the robotic arm conducts, the more learnings it provides to Rapid’s data-driven task library. More operating data means more tasks it can perform.

Why now?

We see three key macro trends thrusting forward the need for M2ML innovation:

- Thanks to machine learning, there was a 16.5% increase in IoT devices online between 2020 and 2021. The enterprise now must explore more sophisticated and “consumerized” tools and interfaces to serve end-user needs.

- Only 13.3% of US workers now sit behind a desk. The rest of us are in the field or on the go, demanding mobile-first productivity.

- COVID-19 has shown us a more automated, resilient future-of-work that extends across the supply chain and beyond the mission critical.

We’ve reviewed thousands of start-ups through our deal-flow process and believe the potential of machine-to-machine learning to digitize the physical world for many startups – bringing faster, more reliable solutions to a wide variety of verticals – is both staggering and exciting. There is massive growth potential and customer value to be realized through this technology. And the startups who will lead the way through what looks to be an impending market downturn will need M2ML to cement their competitive advantage.

In my recent insights paper on M2ML, I discuss these concepts, plus the Rapid Robotics case study, and others, in greater depth. I also explore the thesis that guides Bee Partners’ investment strategy. I’m interested in learning your thoughts and experiences with M2ML. Please reach out to me on LinkedIn.

About Bee Partners

Founded in 2009, by operator-turned-investor Michael Berolzheimer, Bee Partners is a pre-Seed venture capital firm that partners with revolutionary Founders working at the forefront of human-machine convergence across technologies that include robotics, AI, voice, i4.0, and synthetic biology. The firm leverages a singular approach to detecting new and emerging patterns of business as well as inside access to fertile but often overlooked entrepreneurial ecosystems to identify early opportunity in large, untapped markets. Bee’s portfolio companies consistently realize growth at levels that outstrip industry averages and have secured more than $1.5 billion of follow-on capital from the world's top VCs.

Here's what we're looking for: beepartners.vc/lookingfor

Here's what we believe in: beepartners.vc/diversity-equity-inclusion

Want to work in our portfolio? Seejobs.beepartners.vc

No Comments.