Developing the key elements of the stack

Introduction

The world is abuzz -- the past several years have been an exciting time for drones. From videos of drones flying cool missions inside R&D labs to marketing ploys like Amazon's AirPrime, drones have gained the attention of consumers, enterprises and governments. The FAA expected that over 1 million drones would be sold over the 2015 holidays alone, nearly the same amount that were sold in all of 2014. Their ability to shoot remarkable photography, and potentially violate privacy and property rights has led to a flurry of opinions, regulations, and oversight.

As a result, and in spite of legitimate concerns, drone startups raised over $450m in equity funding across 74 deals in 2015. This funding was up 300% versus 2014 on a dollar basis, and up 111% on a deal-weighted basis. Even funds have emerged, dedicated to invest exclusively within drone ecosystem. Here at Bee Partners, we are increasingly asking ourselves, are drones actually a 'sector?'

What may be misunderstood is that the direct US drone market isn't large by relative comparison. Business Insider estimates the 2016 and 2017 US markets to be $2.6b and $3.5b, respectively, much of which are hobbyist drones, akin to toys. Further, growth over the next 10 years is only projected at 120% total, a rate not overly compelling on an annualized basis, particularly to venture investors. As a result, here at Bee Partners we always consider broader business opportunity where drones and its technology drive change within large organizations, and we aim to observe the drone ‘sector’ though a wider lens. We ask about the specific problem the company is solving, who is going to pay for it, and why it is the most effective solution.

The enterprise successes so far have largely benefited from first mover advantage, and now face increasing competition from new entrants providing incrementally better solutions at slightly lower prices. We expect that solution providers will now defend their early customers through expanding their value propositions and outsourcing non-critical drone functions, including hardware, to the lowest bidder. There will be good businesses built in capturing these functionalities and improving upon the technology, but we’d rather focus on expanding the opportunity set here at Bee Partners.

To date, hardware and software services have dominated drone investing. Infrastructure technology has lagged, but will be essential to support more advanced service providers in industrial and commercial applications and to enable true autonomous delivery over longer ranges to the consumer. However, larger drone companies (or end users) adopting component technologies has been difficult because of the extremely tight integration required with the overall system. This is forcing some of these component companies to build out their own hardware, at least at first, further obfuscating the landscape. This may also result in a large number of acquihires – if a company wants to create a drone team, or integrate a component technology, hiring a team piecemeal can be really challenging due to the specialized skillset. It may be much easier and efficient to buy the entire team and its technology.

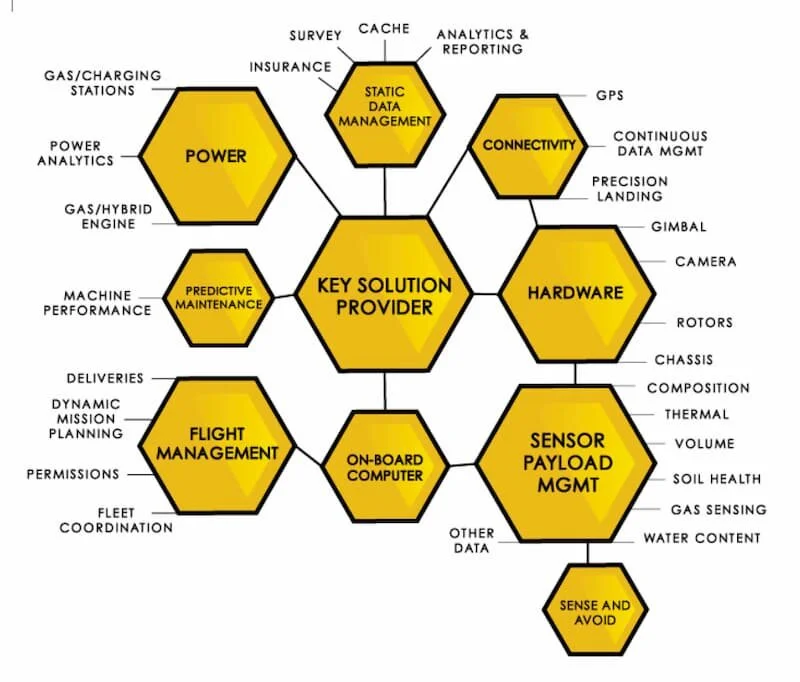

As such, Bee Partners sees the drone investment landscape evolving into a hub and spoke model. At the center is still the solution provider, whose size is variable due to various factors. Many of the supporting functions are outsourced to vertical specialists, and connected to each other at various times:

Drones clearly provide an attractive, cost effective alternative in many situations. They provide us vantage in places heretofore infeasible and can keep humans out of harm’s way. The key solution providers who leverage the drone tech stack on behalf of their customers for specific use cases large and small will thrive. Below we offer some basic archetypes of investments to avoid, as well as attributes we are looking for at Bee Partners in drone-related investments. We hope these will help focus others and us on supporting the right Founders with sustainable business models.

Drone Archetypes We Will Avoid

CONSUMER-FACING HARDWARE

Hardware can be a race to the bottom and is already being dominated by incumbents or adaptations from various electronic manufacturers. Focusing on the consumer first makes it difficult to predict the winners, true of many sectors. The intersection of hardware and consumer, coupled with crowdfunding, bargaining power of suppliers, and low barriers to entry create a significantly higher risk profile for early investors. DJI and Parrot have huge leads here, and consumer products are hard to ship.

INCREMENTAL IMPROVEMENTS

Companies with only slight technology or business improvement will be a drain on capital. Even as certain players broaden their reach up and down the drone stack, a true technological or business breakthrough must provide a step-function improvement over the status quo. Furthermore, any drone solution that requires that customers hire dedicated human operators will not stick around the smart enterprise.

ENTERPRISE COMPANIES WITH UNPROVEN CUSTOMERS

Often nascent industries project customer problems and then create the solutions to solve them, resulting in an arduous and bumpy sales cycle. Perceived pain points may differ from what the target customer wants or needs...or will pay for. Trying to unlock value using a new technology is different than solving real problems for enterprise customers.

TECHNOLOGIES OR BUSINESS MODELS WITHOUT A PLACE IN THE STACK

Hardware and software startups have grabbed market share as the drone stack has emerged. An increasing number of these solutions are being absorbed by adjacent players as developing it themselves is trivial. Deeper tech is harder to plug-and-play due to the tight integration required than the component companies will indicate to a prospective investor. For example, drone countermeasures are now increasingly getting built into the actual drone hardware, squeezing out the 3rd party providers. Drone vision technology companies are building out the hardware themselves, at least to prove concept.

Key Aspects of a Drone Company

HAPPENING NOW

We believe that there remains a window of ~2 more years for this first investment cycle in drones. There is still a land grab occurring in certain areas including on-board computing, connectivity and sensing, and first mover advantage carries extra weight. Though recent and near-term prospects are good in terms of projected percentage growth, we need new business models and use cases to suggest a robust 10-year outlook. 53% of drone investments to date have been angel/seed as evidenced by the early stage bias in the portfolios of focused drone investors, Drone.vc and SkyFund. The current cycle is maturing along the continuum and the investors will meet the companies with capital appropriately.

PLATFORM EFFECT

Not only must a solution provider provide a core solution or service, it must solidify its place in the drone tech stack. This requires other technology (hardware, middleware, and software providers) to build on all sides of the solution, and a structure where each additional client brings more value to the platform. For example, Skyworks AS sensor management platform also allows for developers to continually develop and deploy sensing applications useful to customers. Doing this establishes placement in the stack and promotes network effects.

TECHNOLOGICAL DEFENSIBILITY OR STRATEGIC ADVANTAGE

This includes first mover advantage. As the industry evolves, the key solution providers holding technological and business advantage will succeed, especially those showing platform effects. They will continually strengthen their core position and outsource the commoditized aspects of drone technology (hardware) or business (drone connectivity). Skycatch built out many of these parts as the industry sprouted, and will outsource certain aspects as their solution matures and customer needs are refined.

ABILITY TO EXTRACT DISPROPORTIONATE ECONOMIC RENT

Whether a technology breakthrough/defensibility, strategic advantage, or other, these defensible positions must be supported by thoughtful business models and committed customers. Businesses that help enable delivery or sharpen data collection and sensing will win mindshare and investment as industry players increasingly include them in budgets and workflows. Infrastructure companies will also emerge in the next wave, enabling such technologies as constant connectivity, sense and avoid, or routed delivery. Marketplaces around contract work, images, or other data will also bring viable business models.

Conclusion

Drones hold promise to be a truly enabling technology supporting a variety of crucial global industries. The drone-first solutions to problems both known and to be discovered are foundationally solid, efficient, and effective. The supporting web of hardware, middleware, and software is now substantially robust to provide significant value to certain enterprises. We at Bee Partners are excited as well, but we caution over-optimism as the coolness of the demo involving flying robots whizzing through the sky wears off. Investors must select drone companies by application to a wider business opportunity, and those that can defensibly extract economic rent over the long term. We, alongside entrepreneurs, must be certain we are saving companies both time and money. We must vow to think beyond 'drones' and study the business problems and drone-specific solutions required to solve them. Having the discipline to build and support these companies is extremely difficult, but a better, safer, more efficient workplace will surely be the result.

Garrett Goldberg

Partner, Bee Partners

garrett@beepartners.vc

Michael Berolzheimer

Founder & Managing Partner, Bee Partners

michael@beepartners.vc

Appendix - July, 2016

Six months after first publishing, we’ve seen an explosion of drone based opportunities, technologies, and solutions. This has further refined our thinking and narrowed our investment focus. What has become apparent to us is threefold:

- The majority of these opportunities have been in the KEY SOLUTION PROVIDER hub. While central to our thesis on the drone industry, these opportunities often look like consulting practices that leverage a drone to sell a specific service to the enterprise. These are indeed meaningful solutions for insurance, forestry, police and government, and all have a viable place in the stack. However the landscape is becoming increasingly fragmented and crowded and thus difficult to see where outsized value lies in order to achieve venture scale returns. While many of these opportunities can be built into very nice businesses, we must be realistic about the opportunity size for now.

- We believe there is still true demand on the innovator side. Because so many entrepreneurs (appropriately) jumped straight to providing enterprise and consumer solutions, we are now left with a gap in innovation on the front end of the technology hype curve. What we believe is really needed is a Drone 2.0 reversion to the early technology innovation section of the curve - this will continue to support the key solution providers in expanding areas. We see this with emerging enabling technology companies such as Iris Automation and DroneSmith and believe there is room to run. Solutions around fleet management, smart routing, and other technology aspects of the flying robots will take center stage again.

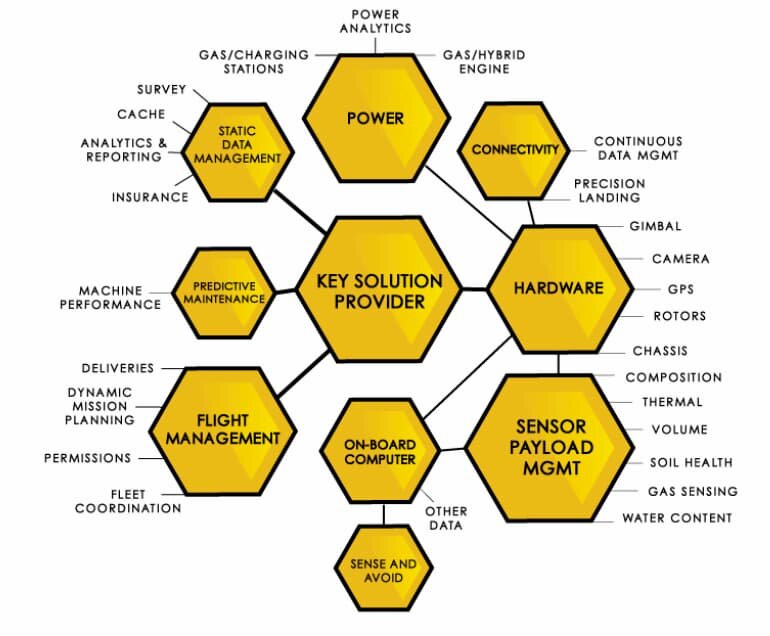

- As a result of the above, we have revised our Hub and Spoke diagram to reflect the rapidly changing dynamics in the industry. We’ve connected the on-board computer directly to the hardware to reflect the need for tight integration between the two. Both flight and data management are now directly associated with the key solution provider, and power will be a limiting factor for some time to come:

Drone 2.0 is necessary to fully enable the drone future we envision. While we do have meaningful customer solutions in the market, certain aspects of technology and regulation must continue to develop to enable a future of scaled delivery or personal aviation. Unfortunately, this may include failures and precedent setting incidents. However this 2nd wave will have greatly benefited from the first cycle of technical innovation leading to unique, drone advantageous solutions. Customers who may have been on the fence (medium enterprises, municipalities and governments) will then dive in further supporting the rise to exceed today’s lofty expectations.

No Comments.